*First things first, I am not here to neither reprimand nor endorse monopolistic or competitive capitalism, but rather to use first principles thinking as a systematic approach on how some relentless monopolistic markets use decentralized tactics to inevitably excel past expectations compared to markets in perfect competition. This type of thinking is highly encouraged by Aristotle (philosophical works), Descartes (Cartesian Doubt), and Elon Musk (SpaceX, Tesla, Solar City, The Boring Company).

We’ll analyze the mammoths, Microsoft and Google, and use reasoning to find out which of these companies are going to survive and which will fail due to lacking any type of decentralized organizational structure.

“With first principles, you boil things down to the most fundamental truths … and then reason up from there.”

First Principles Thinking and Capitalism

* First principles thinking requires you to dig deeper and deeper until you are left with only the foundational truths of a situation. Rather than going with the popular notion of something and thinking “It is what it is,” we will derive it, question it, and essentially think like a scientist. Often, when individuals think of companies with monopolistic traits, they think of evil, greedy businessmen whom will do anything to maintain control of their respective market in return for flourishing profits.

The sad truth is… this may not necessarily be a wrong assumption in some cases. Regardless, every monopoly is unique and therefore, we must ask ourselves and delve further into: How are they succeeding at what they do? Can any other firm offer a close substitute to their product? How does it distinguish itself from other monopolies? How does it compare to a competitive market in terms of profits? Why are all monopolies presumably generalized as deceptive?

If you were to ask an economist what a monopoly was, they would all give you a similar response: A treacherous firm using methods of deception to eliminate its competition and secure their respective market, by either acquiring a government patent of some sort for their product or merely using trendsetting methods to get to the top of the food chain. On the contrary, we have the highly encouraged competitive market, also known as Perfect Competition.

This type of market is a benchmark in capitalism in which achieves equilibrium (a state in which opposing forces or influences are balanced) when producer supply meets consumer demand. Essentially, any and every firm in a competitive market is undifferentiated and sells the same, unvaried products. The firms in Perfect Competition do not have market power and therefore market price is not determined by these firms, but rather whatever the market determines.

In the majority of entry level economics courses, an individual will be quick to notice that a professor will favor a competitive market over a monopolistic market. But why is it preferred and accepted as the standard? This history lesson brings us back two centuries ago when economists copied their mathematics from the work of 19th-century physicists, like Sir Isaac Newton. Aspiring economists such as William Stanley Jevons and Léon Walras wanted to make economics a science as reputable as physics was at the time.

These economists drew their diagrams in clear emulation of Newton’s style (inspired by the way that gravity pulls a falling object to rest) and essentially compared it with the role played by market forces and mechanisms in pulling an economy into equilibrium. In this primitive economic theory individuals and businesses were deemed as interchangeable atoms, rather than unique creators. This concept may well apply in the laws of physics, but needs to be seen from a different viewpoint when analyzing businesses. As perfectly stated in Peter Thiel’s book Zero to One, “Their theories (19th-century physicists) describe an equilibrium state of perfect competition because that’s what’s easy to model, not because it represents the best of business.”

Bluntly said, if your business is in an industry in which competitive equilibrium applies (Perfect Competition), then don’t expect the world to care if it crashes and burns because there will always be another undifferentiated competitor within that respective market ready to step up to the plate and take your business. When creating a business one can either follow the conventional structure of their predecessors, which falls into the perfect equilibrium, or create something of pristine, long-lasting value. The latter, as all new creations, will be nowhere in proximity of the equilibrium.

•••

“Every Business is Successful Exactly to The Extent That it Does Something Others Cannot” — Peter Thiel

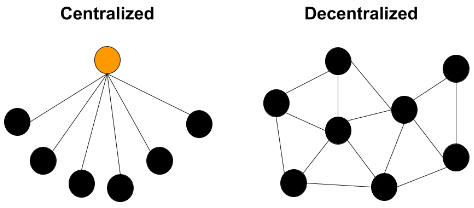

Generally speaking, companies can either be centralized, decentralized, or hybrid (mix of both). Sometimes it can be utterly demanding to distinguish where a company falls within one of these organizational structures. However, observing and scrutinizing distinct characteristics of companies will make it feasible to detect. Centralized organizations can be defined as a hierarchy decision-making structure where all decisions and processes are handled strictly at the top or executive level. In a centralized organization, even those decisions regarding everyday operations and processes are generally decided upon by upper level executives or the business owner. On the opposite end of the organizational spectrum you will find a company that is operated based on a decentralized organization or rather a company that is operated on delegation of decision-making powers and flexible processes. In other words, executives or business owners assign tasks to management and employees and give them the power to fulfill the tasks in anyway they deem fit.

In many of these organizations, management and employees have the freedom to try out new approaches that would help the firm without direct permission from upper management. As shown in the image above, in a centralized organization all decisions must go through the CEO, or whoever is in charge (orange dot). Policies are put in place to ensure the rest of the company follows the direction of the executives. On the contrary, in decentralized organizations there may not always be a CEO in charge and decisions are made with more freedom and flexibility. Everyone involved in the decentralized organization is heard and most importantly, their ideas and input are taken under full consideration.

Most companies tend to be centralized, in which they have a CEO making the imperative decisions, followed by the CIO, CFO, COO, and top executives below that. The problem with this organizational structure is lack of innovation and creativity. People in position of power need to understand that great ideas come from people who are closest to the ideas. For massive companies, having a hierarchical (centralized) organization is an effective way to keep things under control, although moving from centralized to decentralized in the organizational spectrum has its benefits. It does not have to be a radical change from one side of the spectrum to the other, but moving anywhere closer to the decentralized side will stimulate innovation.

•••

A Financial Take on Google and Microsoft

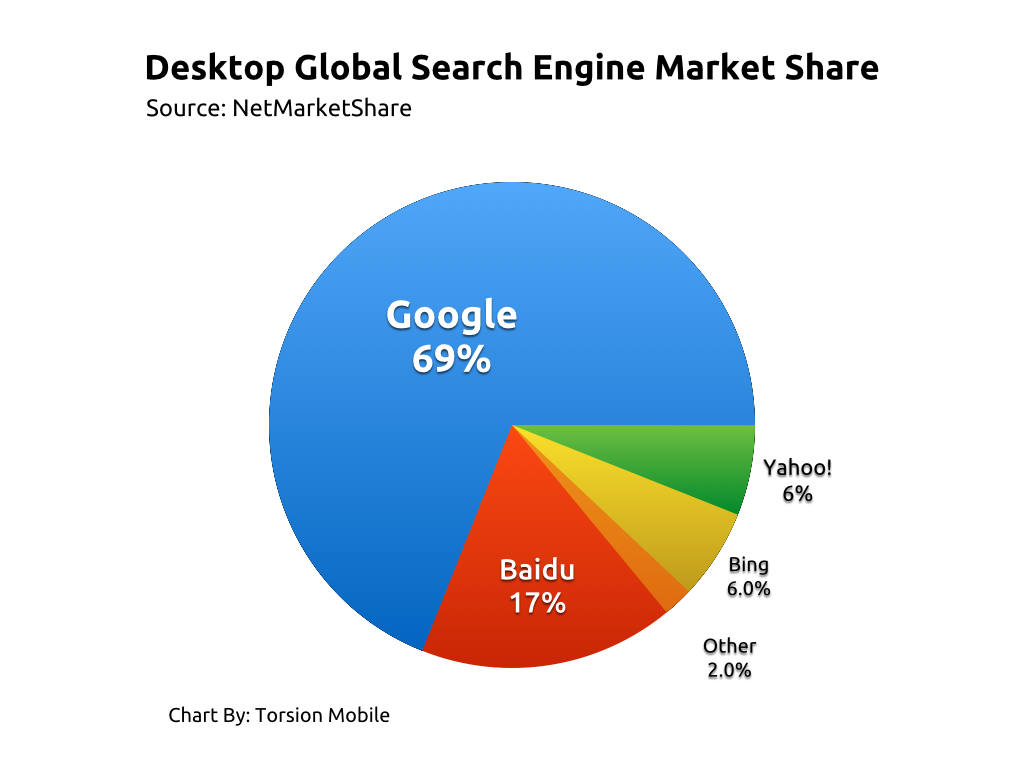

Let’s take a look at Google and Microsoft, for instance. Of course, there are other search engines like Microsoft’s Bing, Yahoo, Ask.com, Duck Duck Go, etc., but we all know Google is the top dog which distinguished itself as a multifaceted tech company and essentially created its own market. The same could be said about Microsoft and their operating system that dominates the market share.

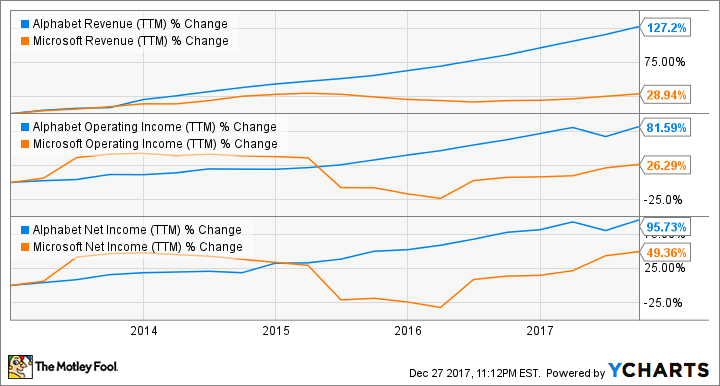

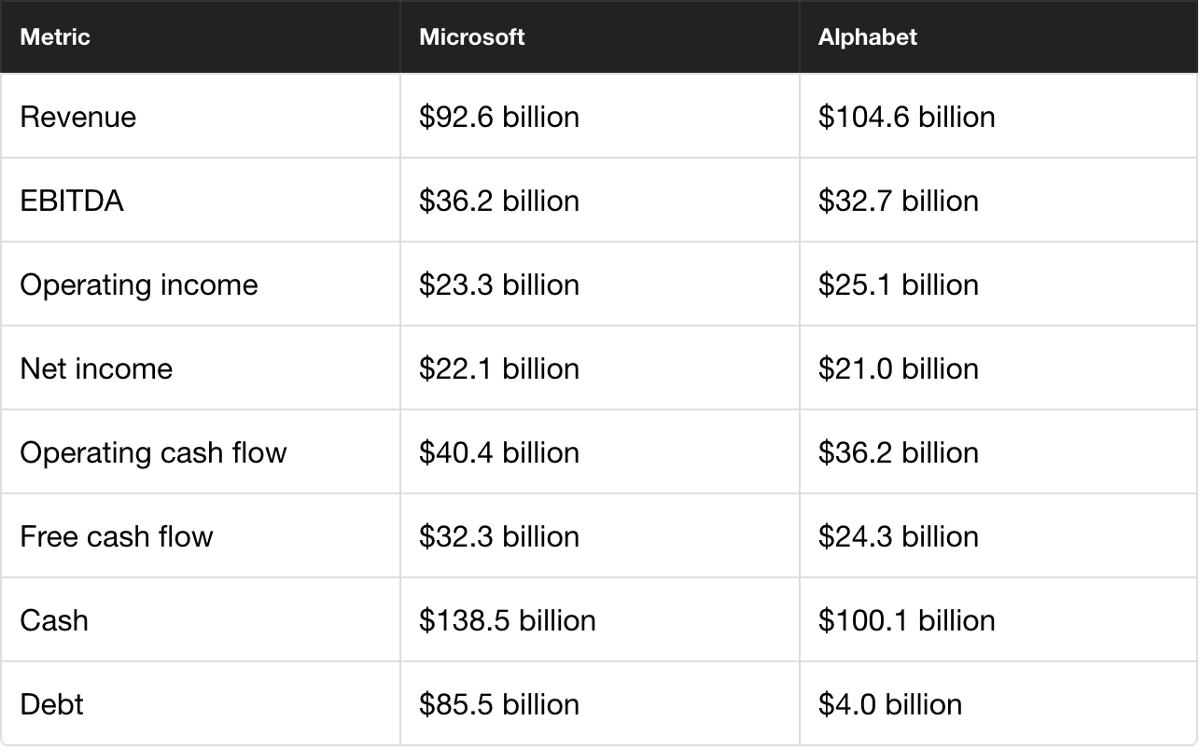

However, Google’s rise to prominence happened much quicker considering the ingenuity of their products and marketing approach as a technology company rather than merely a search engine. This did not happen by luck; it’s a strategic organizational structure well-defined in Google’s culture of moving along the spectrum closer to decentralization. By no means am I saying that Google is as decentralized as can be, but they are certainly using decentralized methods to their advantage. As we can see in the table below, Alphabet (Parent company of Google), is not too far behind Microsoft in terms of its financial metrics. Alphabet’s net cash flow is $96 billion compared to Microsoft’s $53 billion. Net cash flow is the fuel that helps companies expand, develop new products, buy back stock, pay dividends, or reduce debt. It is what allows companies to conduct their day-to-day business.

Moreover, in terms of revenue and profit growth, Google is the clear winner for the past recent years. In Microsoft’s case, the saying “age is just a number”couldn’t be more accurate. Google was founded in 1998 while Microsoft has been around since 1975. Interestingly enough, the two-decade advantage Microsoft has on Google does not reflect on its financial metrics. All things considered, Google’s innovation and the way it operates is what allows its growth to continue rising over Microsoft; something that has gotten more attraction over the years from both investors and consumers.

•••

Monopolies and Legality

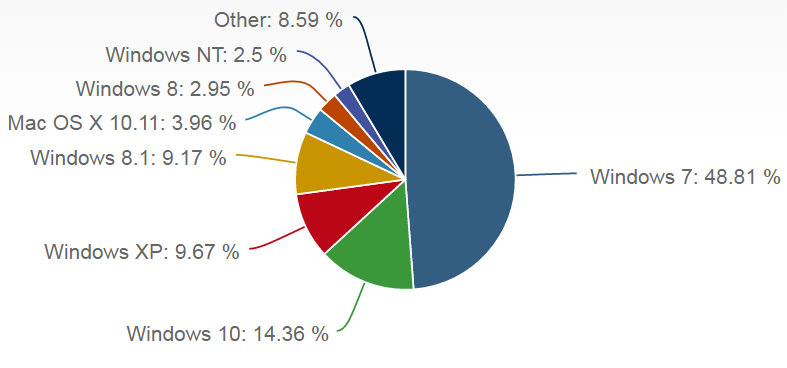

In legal terms, Microsoft is no tdeemed a monopoly since there are other competing firms selling operating systems (Perfect Competition), but this was challenged in United States v. Microsoft Corp. In technical terms, when Microsoft holds about 90% of the operating systems market share, I can undoubtedly say it is indeed a monopoly. In fact, the European Union would agree with me, and they even proved it in court when they successfully sued Microsoft (Microsoft Corp v Commission).

It may not be acknowledged in the United States due to the laws governed, but the European Union also sued Google for similar reasons neighboring monopolistic actions (European Union vs. Google). Based on these statistics (search engine market share pie chart) we can inherently make the conclusion that both of these companies are monopolies of some sort in their respective market. Nevertheless we cannot make the unconscious assumption that these are nefarious companies just because our professors from Economics 101 told us so.

•••

The Impact of Decentralization on Monopolies

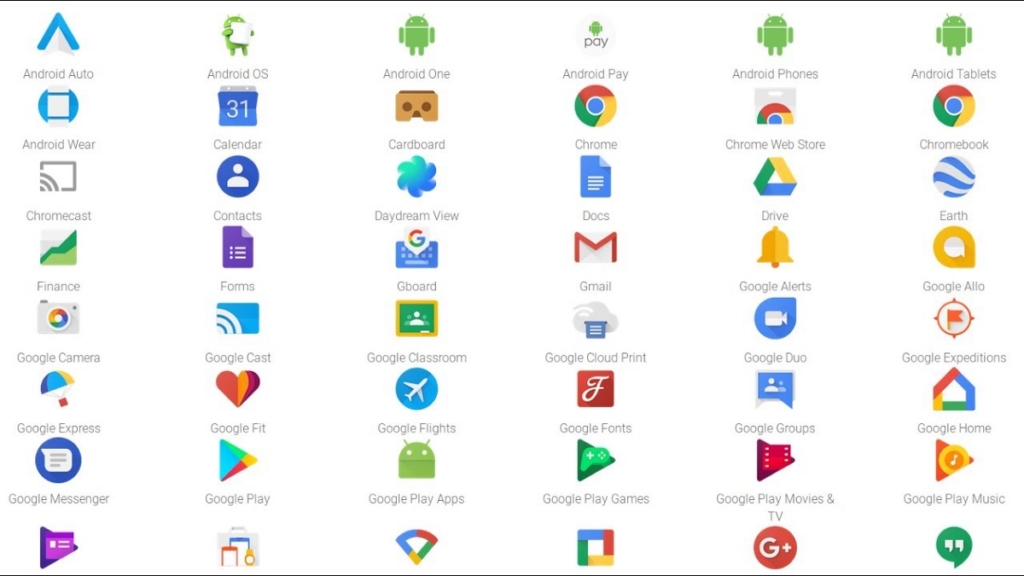

Evidently, there are two sides of this story… The inside-out perspective of an employee from one of these monopolies, and of course, the outside-inperspective of the average consumer using or purchasing the product of a monopoly. Starting with an inside-out perspective, Google’s decentralized methods are known for encouraging personal creativity and innovation. For this exact reason, products like Gmail, Google Maps, and Google Chrome (The list goes on and on…) have been created. Google does not have to worry about competition or profits, and therefore has more of an inclination to care more for its workers, products, and how it could help the world for the greater good. Rather than concentrating on one specific product, they have expanded from a search engine to a tech company with over 30 products to offer.

They have allowed their employees’ curiosity to ignite by giving them the time they need to be creative and merely think of how a future product can use technological capabilities to do more for less. Google’s former CEO and Chairman, Eric Schmidt, has even gone so far to implement the 20 Percent Rule for employees. The famous free-time rule, allows employees to spend 20 percent of their time on anything they want. Instead of controlling employees’ every move, Google allows for inquisitiveness which causes new products to be born.

Although it does resemble a centralized organization with a CEO, hierarchy, and politics, it has clearly implemented decentralized methods. By giving freedom to its employees and having the willingness to accept any feedback or creative ideas, it has prevailed into the mammoth of a company it is today. Monopolists like Google can afford to think about things other than making money. Companies in a Perfect Competition are constantly focused on margins that they lack creativity and the time to plan for future growth.

Although, not all companies use their monopolistic traits to their advantage. Microsoft has been fixated on primarily selling its operating system, Windows and Microsoft Office software since the company’s inception. Matt Rosoff, a former Microsoft employee stated, “No matter what part of the company they work in, my friends at Microsoft know their paycheck comes every week, thanks to product sales of Windows and Office. And no matter what product they work in, whether it’s set-top boxes or mobile phones, their objectives are overwhelmed by the need to sell more copies of Windows and Office. Meetings at Microsoft have become famous for having a dozen-plus attendees — all in order to maximize integration with, you guessed it, Windows and Office.”

If Microsoft became more decentralized, it could start by marketing their products independently and letting creativity spark within its employees rather than focusing on its two main products that have been around since the 1980’s. Decentralization leads to stand-alone products that could function independently as separate businesses rather than bundles that go hand in hand.

If Google Maps, for instance, were to crash and not meet consumers’ expectations would the company be majorly affected? Probably not, considering it is a stand-alone product within Google and only accounts for one the 35+ independent products they have to offer. On the other hand, if Microsoft’s Office bundle, which is comprised of at least 10 interrelated products, does not meet consumers’ expectations sometime in the future, that would account for nearly a quarter of its total revenue.

As seen in images above, Microsoft only has a handful of products compared to Google. From an outside-in perspective of the consumer using Google or Microsoft, opinions vary widely. All of Microsoft’s products excluding Bing and MSN cost the consumer money or limitations on the features and capabilities of the software for the free version. On the other hand, most of Google’s products are free of charge, used as an incentive to remain using Google’s services. From a consumer’s standpoint, assuming both companies being compared offer quality products, would you prefer the company that gives you all these products/services free of charge or would you prefer the company that makes you pay a monthly/yearly subscription?

Both of these companies, or so called monopolies, have the capabilities and capital to keep innovating and finance long-term research projects using decentralized methods that spark creativity. Although, it is clear that only one of these monopolistic firms are putting it to effective use, something most companies in a Perfect Competition are financially restricted from doing so. Monopolies like Microsoft will only prosper for so long. With Apple’s innovative operating system (iOS), mobile computing has significantly increased and therefore decreased sales in one of Microsoft’s leading products, its operating system.

Prior to that, IBM’s hardware monopoly of the 1970’s was overtaken by Microsoft’s software monopoly. Monopolies drive progress due to the proven methods of long-term monopoly profits, which in turn create an incentive to innovate. History reveals that technological advances are drawn from ambitious monopolies replacing its predecessors (past monopolies).

It’s only a matter of time before another innovative company thrives from the creation of unparalleled business applications offering more for less, leaving Microsoft’s main profit-driven product in ashes.

Diego Leon is a student at the Florida State University,

Software Engineering Intern at JP Morgan Chase & Co.,

and Striving Entrepreneur

Connect with Diego on LinkedIn